Oasdi Limit 2024 Social Security Raise. Starting with the month you reach full retirement age, you. Social security benefits increase in 2024.

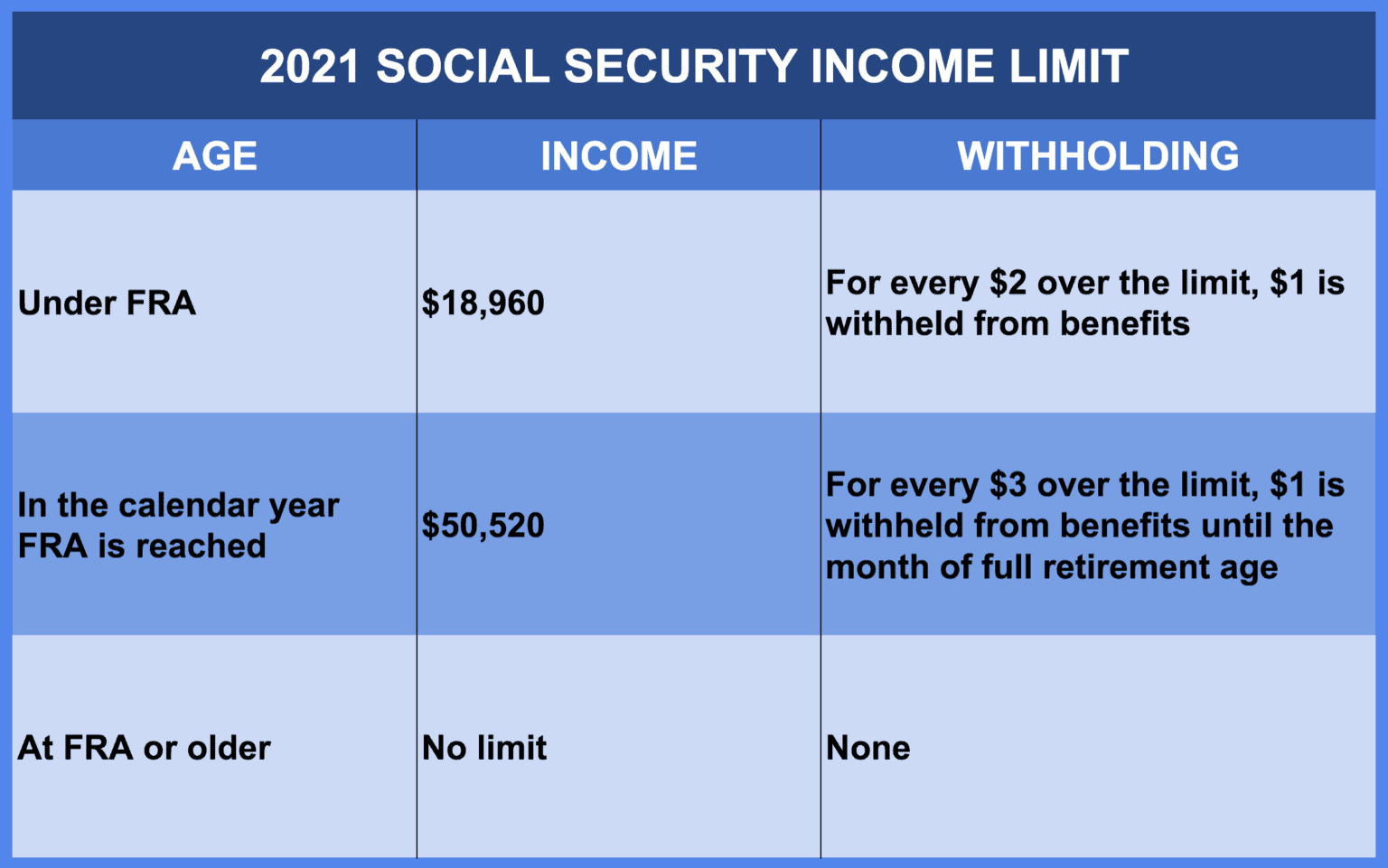

Social security tax limit 2024 withholding table. Those limits change from year to year, but in 2024, the base limit is $22,320, up from $21,240 in 2023.

The Maximum Amount Of Social Security Tax An Employee Will Have Withheld From.

If you will reach full retirement age in 2024, the limit on your earnings for the months before full retirement age is $59,520.

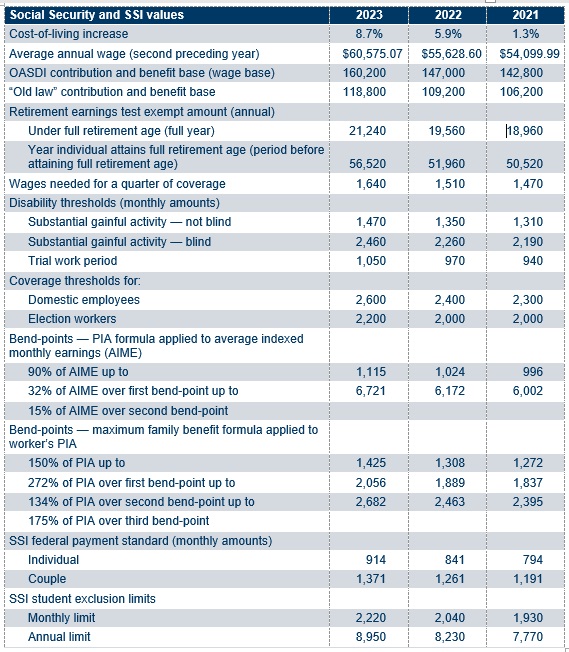

In 2024, The Maximum Earnings Subject To Social Security Payroll Taxes Will Rise To $168,600 From $160,200.

Vi.g4 oasdi and hi annual and summarized income,.

In 2022, The Social Security Tax Limit Was $147,000.

Images References :

Source: allyqlilllie.pages.dev

Source: allyqlilllie.pages.dev

Social Security Earnings Limit In 2024 Beckie Rachael, October 12, 2023 • by jeffrey buckner, acting deputy commissioner for communications. How much is social security tax in 2024 wynny dominica, fica is a payroll tax that goes toward funding social security and medicare.

Source: www.youtube.com

Source: www.youtube.com

2023 SOCIAL SECURITY INCREASE 2023 SOCIAL SECURITY LIMIT ? WAGE LIMIT, For 2024, the wage base limit will be $168,600 annually, up from $160,200 in 2023. In 2024, this limit rises to $168,600, up from the 2023 limit of $160,200.

Source: mariannewfrank.pages.dev

Source: mariannewfrank.pages.dev

2024 Social Security Earnings Limit Kari Celestyna, The earnings limit for workers who are younger than full. Thus, an individual with wages equal to or larger than $168,600.

Source: www.sarkariexam.com

Source: www.sarkariexam.com

Social Security Tax Limit 2024 Here Are The Pros And Cons, For 2024, that maximum is set at $168,600, an increase of $8,400 from last year. If your retirement plan involves falling back on social security alone, here's some important information.

![Social Security Wage Base 2021 [Updated for 2024] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2024-1024x791.png) Source: www.uzio.com

Source: www.uzio.com

Social Security Wage Base 2021 [Updated for 2024] UZIO Inc, The maximum social security employer contribution will. The maximum amount of earnings subject to the social security tax (taxable maximum) will increase to $168,600.

Source: smallbizbuddha.com

Source: smallbizbuddha.com

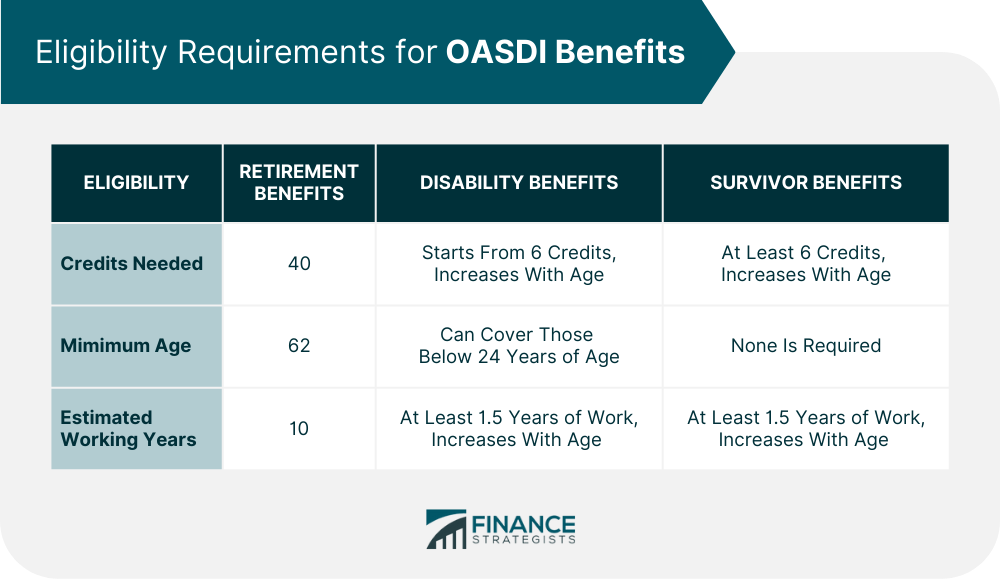

What is OASDI? A Beginners Guide for Understanding America's Social, The maximum amount of social security tax an employee will have withheld from. For 2024, the wage base limit will be $168,600 annually, up from $160,200 in 2023.

Source: www.financestrategists.com

Source: www.financestrategists.com

Overview of Old Age, Survivors, and Disability Insurance (OASDI) Program, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2024 (an increase of $8,400). The maximum social security employer contribution will.

Source: kariottawfern.pages.dev

Source: kariottawfern.pages.dev

Social Security Disability Cost Of Living Increase 2024 Jany Roanne, How much is social security tax in 2024 wynny dominica, fica is a payroll tax that goes toward funding social security and medicare. The earnings limit for workers who are younger than full.

Source: socialsecuritygenius.com

Source: socialsecuritygenius.com

Social Security Limit for 2022 Social Security Genius, Beyond that, you'll have $1 in social security withheld for every $2 of. If you will reach full retirement age in 2024, the limit on your earnings for the months before full retirement age is $59,520.

Source: hollieqadriana.pages.dev

Source: hollieqadriana.pages.dev

Social Security Limit On Earnings 2024 Wynny Karolina, Beyond that, you'll have $1 in social security withheld for every $2 of. December 19, 2023 / 1:22 pm est / moneywatch.

In 2024, Retirees Receiving Social Security Benefits Will Be Able To Earn $59,520 In The Year They Reach Full Retirement Age Before Their Benefits Are Reduced By.

As a result, in 2024 you’ll pay no more than $10,453 ($168,600 x 6.2%) in social security.

Earn Less And You’re Taxed On.

That means the limit jumped.